“We keep hearing about the price of waiting …”

The Art of Buying and Selling: The Perils of Waiting for Price Drops

In the dynamic world of buying and selling, whether you're dealing in real estate, stocks, or consumer electronics, timing is everything. Many buyers adopt a strategy of waiting for price drops, hoping to snag a deal at the lowest possible price. However, this approach is fraught with risks and potential pitfalls. Here’s why waiting for price drops can be more dangerous than you might think.

1. Market Volatility and Unpredictability

Markets are inherently unpredictable. Prices fluctuate based on a multitude of factors including supply and demand, economic conditions, political events, and even natural disasters. Waiting for prices to drop assumes that you can predict the market's movements, but in reality, this is almost impossible.

For instance, during the COVID-19 pandemic, stock prices experienced extreme volatility. Those who waited for further drops often missed out on buying opportunities during market recoveries. Similarly, in real estate, waiting for property prices to decline might lead to missing out on prime properties that never see the expected drop.

2. Opportunity Cost

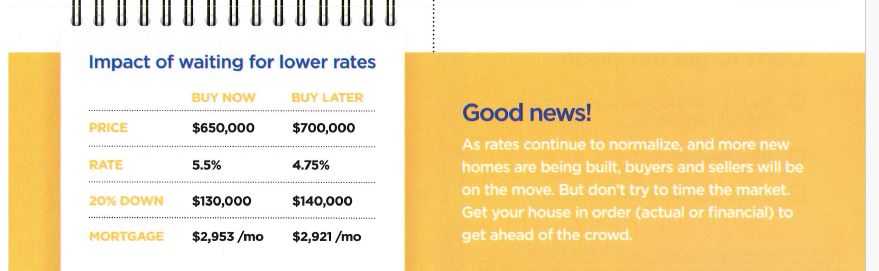

The concept of opportunity cost is crucial in the buying and selling landscape. When you wait for a price drop, you're essentially foregoing the benefits that could be gained from making a purchase or investment now.

Consider the stock market again. If you wait for a stock price to drop, you might miss out on dividends or potential gains from an upswing. In the technology sector, waiting for prices to drop on a new gadget could mean you miss out on the latest features and innovations that could enhance your productivity or enjoyment.

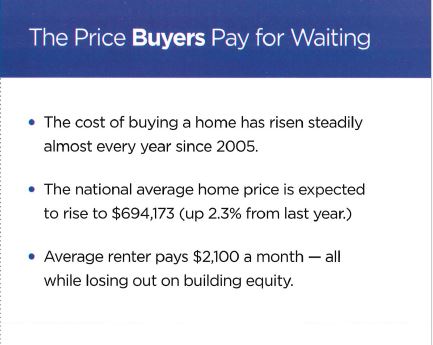

3. Inflation and Cost of Waiting

Inflation is another critical factor. Money loses value over time, and the longer you wait, the less purchasing power your money has. In periods of high inflation, the prices of goods and assets tend to rise. Waiting for a price drop in such a scenario could result in higher prices later, diminishing the advantage you sought in the first place.

4. The Psychological Trap

Psychologically, waiting for price drops can become a never-ending cycle. Once prices drop to your desired level, the temptation is to wait for them to fall even further. This can lead to perpetual indecision and missed opportunities. It's important to recognize and break this cycle to make informed and timely decisions.

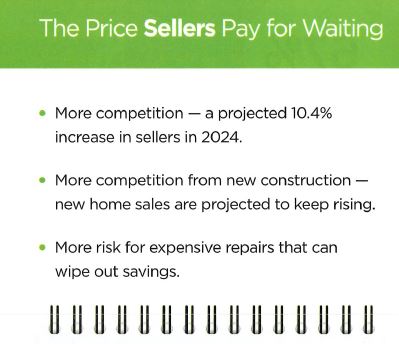

5. Limited Availability and Demand Surge

Certain items or assets have limited availability. Waiting for a price drop can mean that by the time the price is right, the item is no longer available. This is particularly true for limited edition products, real estate in prime locations, or stocks of a high-growth company. Additionally, a significant price drop can lead to a surge in demand, when demand spikes, the waiting game can backfire spectacularly, leaving you empty-handed.

Strategies to Mitigate Risks

While waiting for price drops is risky, strategic planning can help mitigate some of these dangers:

1. Research and Market Analysis: Stay informed about market trends and conduct thorough research. Understand the factors that influence price changes and set realistic expectations.

2. Set a Target Price and Timeframe: Determine a reasonable target price and timeframe for your purchase. If the price drops to your target within the timeframe, make the purchase.

3. Budget for Current Prices: When budgeting for a purchase, consider current prices rather than speculating on future drops. This ensures that you’re financially prepared to make the purchase when necessary.

4. Be Ready to Act: When prices do drop to an attractive level, be prepared to act quickly. Hesitation can result in missed opportunities.

Conclusion

While the allure of waiting for price drops can be strong, the associated risks and potential downsides often outweigh the benefits. Market volatility, opportunity costs, inflation, psychological traps, and limited availability can all turn waiting into a losing strategy. By staying informed, setting realistic goals, and being prepared to act, you can make smarter buying and selling decisions and avoid the perils of waiting for price drops.

Royal LePage Kelowna

Independently Owned & Operated

250.860.1100

1-1890 Cooper Road,

Kelowna, BC, V1Y 8B7

The trade marks displayed on this site, including CREA®, MLS®, Multiple Listing Service®, and the associated logos and design marks are owned by the Canadian Real Estate Association. REALTOR® is a trade mark of REALTOR® Canada Inc., a corporation owned by Canadian Real Estate Association and the National Association of REALTORS®. Other trade marks may be owned by real estate boards and other third parties. Nothing contained on this site gives any user the right or license to use any trade mark displayed on this site without the express permission of the owner.

powered by WEBKITS